Strategic Direction

Housing

The Landcom Way

Our mission to create more affordable and sustainable communities is guided by three Strategic Directions – Housing, Partnerships and Leadership.

Throughout the year we have been developing our FY22-24 Strategic Plan to guide our future leadership ambitions. This includes outcomes and targets for:

- affordable, diverse and accessible housing;

- meeting new demands for living and working locally; and

- delivery of climate resilient communities.

The following case studies showcase our role in unlocking government-owned land and driving industry innovation.

They also illustrate our unique capabilities to optimise public investment in infrastructure and boost housing

Market context

In FY21 we supplied 4,049 dwellings to the market directly or through our partners.

We entered FY21 with the Federal Treasurer conceding that the economy was in recession and with governments at all levels looking at measures to stimulate a post-COVID-19 recovery. Despite the conditions, we maintained our financial results while successfully delivering housing supply, affordability, diversity and sustainability.

The first half of the year was very subdued in both the wholesale apartment site market and the retail homesite sale market due to the recessionary impacts of the COVID-19 pandemic. The second half of the year saw a noticeable split in the markets, with retail homesite sales moving into boom conditions due to a recovery driven by government property stimulus packages and rapidly improving employment figures. The wholesale apartment site market flattened out and did not recover. While we experienced demand for wholesale apartment sites, the pricing recovery has been patchy.

The second half of the year saw retail homesite sales recover most of the full year forecast from an extremely slow first half. This sales recovery was boosted by stimulus and a lack of supply. The market did not forecast the rate of bounce back in the homesites sector and this sentiment further impacted availability and the supply pipeline. This constrained supply also caused rapid price increases in the homesites market. The wholesale apartment site market remained subdued for much of the year with developer buyers returning to the market in the third quarter but with pricing expectations generally lower when sites were offered by tender. The sale of Menangle Park (Site B) was our major transaction in this section of the market and was contracted well before the impacts of the pandemic.

Despite these conditions we finished the year with an increase in retail activity in the second half of FY21 on the back of Australian Government stimulus measures targeted at lower income earners and house and land packages under a $950,000 limit. These measures supported our target markets in the northwest and southwest of Sydney.

FY22 will see us in a rebuilding phase and with a pipeline of projects in Sydney’s southwest, west and northwest. Where possible we will increase our development operations activity to support jobs and maximise our returns during the post-COVID-19 recovery in the retail sector of the market.

Our actions to build production, secure project pipelines, leverage public investment in infrastructure and unlock sites through partnerships, will support the development and construction industry and jobs, bring social and economic benefits and help to take the pressure off housing affordability by increasing supply and diversity.

Landcom plays a unique role to leverage Government policy, assets and infrastructure investment to maximise the returns to Government, and unlock delivery through the development industry. At the same time Landcom continues to positively drive change in the industry through our aspirational objectives in creating more affordable and sustainable communities.

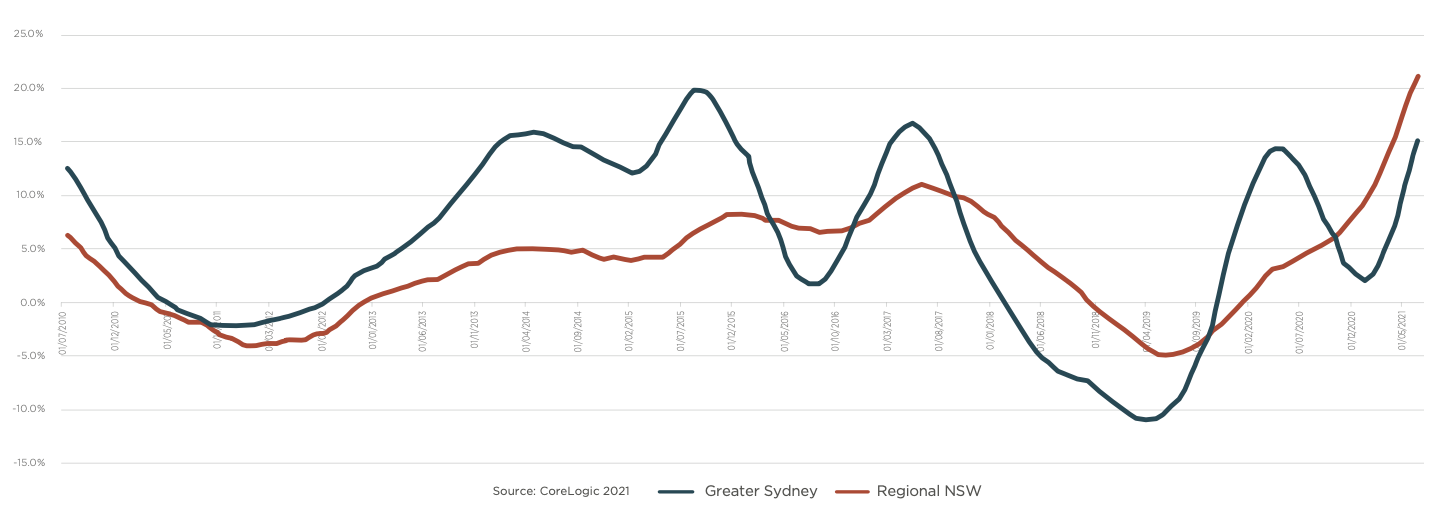

Dwelling price changes Greater Sydney and Regional NSW 2010-2021